Despite recent uncertainty around federal funding, the sustainable success of cities will depend on their leadership’s ability to foster a strong tech economy.[1] Smaller communities that are adjacent to large metropolitan areas and interested in developing their own technology-driven economies are most likely to achieve success by identifying and pursuing a specific industry niche aligned with the sector specializations and workforce strengths of the neighboring metros. Two recent TIP clients, the City of Rock Hill, South Carolina, and the Town of Sahuarita, Arizona, are illustrative examples of this targeted approach.

Rock Hill, South Carolina

Located fewer than thirty miles from downtown Charlotte, North Carolina, Rock Hill sits just across the Carolina state line. Historically a textile powerhouse (and a site of significant events in the Civil Rights Movement), it has endeavored to reconfigure its local industry for the modern economic landscape. With this intention, the Rock Hill Economic Development Corporation engaged TIP to develop a strategic plan for bolstering the city’s technology ecosystem. Three target sectors stood out in subsequent quantitative and qualitative analysis: Sports & Health Technology, Financial Technology (fintech) & Cybersecurity, and Advanced Materials & Manufacturing.

Each sector identified by TIP reflects Rock Hill’s existing assets while leveraging tech-driven innovation taking place in nearby Charlotte—especially in fintech and cybersecurity. Charlotte is known nationwide as the second largest center for financial services corporations, behind only New York City. Not only is it home to Fortune 500 companies like Bank of America, but it also houses the offices of major players in the fintech space like Cash App and Coinbase. This combination of legacy institutions and emerging firms creates a robust regional ecosystem that supports research and development (R&D), entrepreneurship, and sector expertise in fintech and cybersecurity. TIP determined that Rock Hill stands to gain from Charlotte’s financial industry dominance by amplifying its business attraction efforts and supporting the growth of its next-generation talent and workforce. Stakeholders representing a wide array of regional organizations and interests underscored the opportunities presented by proximity to the metro.

By targeting Charlotte-based economic drivers, including financial services firms and venture capital funds with a fintech focus like CFV Ventures, Rock Hill can position itself as a business-friendly and lower-cost destination for expansion and relocation. Winthrop University, Rock Hill’s primary higher education institution, recently created its degree program in Financial Technology, due to debut this Fall. This investment in talent development is critical because most finance careers require at least a bachelor’s degree and offer above-average wages—even at entry level—which can help drive local spending, innovation, and long-term economic growth. The alignment between local assets, targeted industries, and the metro’s sector strengths demonstrates a replicable model for smaller communities seeking to develop technology-driven economies near major urban centers.

Sahuarita, Arizona

Further west, Sahuarita, Arizona, offers another example of a smaller community working to define its economic identity by building on regional assets and proximity to a larger metro. Located between the city of Tucson and the US-Mexico border, Sahuarita is a small but growing town incorporated in 1994. Historically, it was dominated by the mining industry and remains the site of large mining operations today, including those of companies like ASARCO and Freeport-McMoRan. The sheer scale of these copper mining sites, with their massive equipment and facilities, presents challenges for utilities infrastructure and quality of place. At the same time, the town’s commuter data indicate that most employed residents in the community drive to Tucson for work. As part of efforts to diversify its industry mix and brand itself as more than a residential community, Sahuarita hired TIP to help devise an economic development master plan focused on people, prosperity, and place.

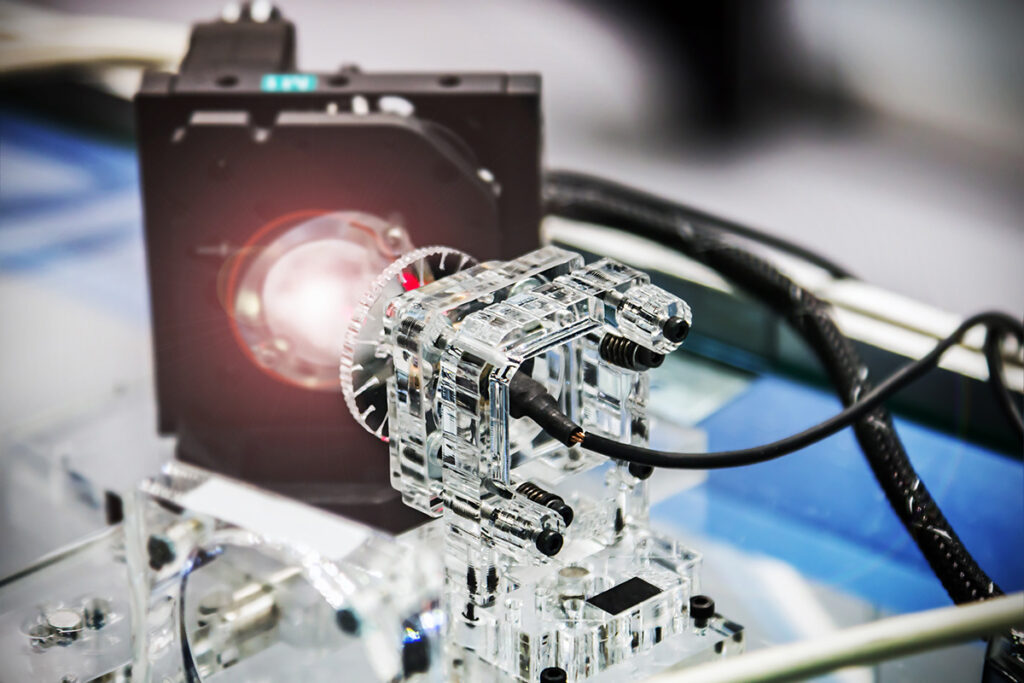

Its 15-mile proximity to Tucson provides prime opportunities for collaboration with the University of Arizona (UA), both as a talent pipeline and an R1 research institution in high-tech fields. The university and the town maintain a partnership in the mining industry—combining its School of Mining & Mineral Resources with the UA-owned San Xavier Mining Laboratory in Sahuarita—which the master plan identifies as an opportunity to capitalize on existing shared strengths. The plan also highlights the region’s growing specialization in optics, driven by UA’s Wyant College of Optical Sciences. Earning the Tucson area the title of “Optics Valley,” this high-tech research focus at UA has produced a new viable target industry niche for Sahuarita: photonics. This is a strategic pivot reflected in the master plan’s emphasis on emerging, knowledge-intensive clusters.

The Sahuarita Advanced Manufacturing and Technology Center (SAMTEC), which opened for business in 2020, houses 32,000 square feet of light industrial and office space, intended to kickstart the town’s next-generation industry clusters. PowerPhotonic, a Scotland-based manufacturer of wafer-scale optics materials that have applications in advanced laser systems, became SAMTEC’s anchor tenant, with an estimated five-year economic impact of $32 million and dozens of jobs created. Although the optics connection is still nascent, the master plan helps position Sahuarita to leverage its geographic location, university partnerships, and targeted investment for real results within a narrowly defined sector.

Rock Hill and Sahuarita illustrate how smaller communities can carve out a place in today’s tech economy by capitalizing on the innovation strengths of nearby metros and narrowing their focus to industry niches that reflect local assets. Their efforts underscore a critical takeaway: success in tech-driven economic development does not require replicating the scale or scope of major urban centers. Instead, it requires strategic alignment, deliberate investment in talent and infrastructure, and a long view that prioritizes fit over breadth. Communities that pursue a focused, regionally connected model will be best positioned to build resilient, future-ready economies.

[1] For example, the Economic Development Administration’s Regional Technology and Innovation (Tech Hubs) program canceled awards announced in January 2025 and will reopen the funding competition in early 2026. Meanwhile, the National Science Foundation’s Regional Innovation Engines program remains underfunded compared to the authorization under the CHIPS and Science Act. See https://www.nado.org/tech-hubs-relaunch/and https://www.science.org/content/article/analysis-how-nsf-s-budget-got-hammered for more.