The super-heated housing market that dominated headlines and led to sky-high housing prices during the COVID-19 pandemic has cooled. Yet, high prices relative to pre-pandemic levels and reduced affordability have lingered, pointing to a continued housing shortage. The impact of housing affordability on the workforce and on the ability of businesses to attract and retain talent has made it a central concern for economic developers.

The implications of high housing costs are spelled out in the State of the Nation’s Housing report prepared annually by Harvard University’s Joint Center for Housing Studies. The 2023 study highlights challenges facing the growing number of renters and homeowners who are cost burdened, defined as households spending 30 percent or more of their income on housing. By definition, cost-burdened households have lower residual incomes, meaning that housing needs are sometimes met at the expense of necessities like food and healthcare. This balancing act may lead some residents to choose to live and work in more affordable areas creating a significant impact on the local talent pool. Because businesses are increasingly weighing the availability of talent in their expansion and relocation decisions, lack of housing affordability can impact business development efforts, hinder economic growth, and exacerbate wealth disparities.

The Housing Shortage Has Been Years in the Making

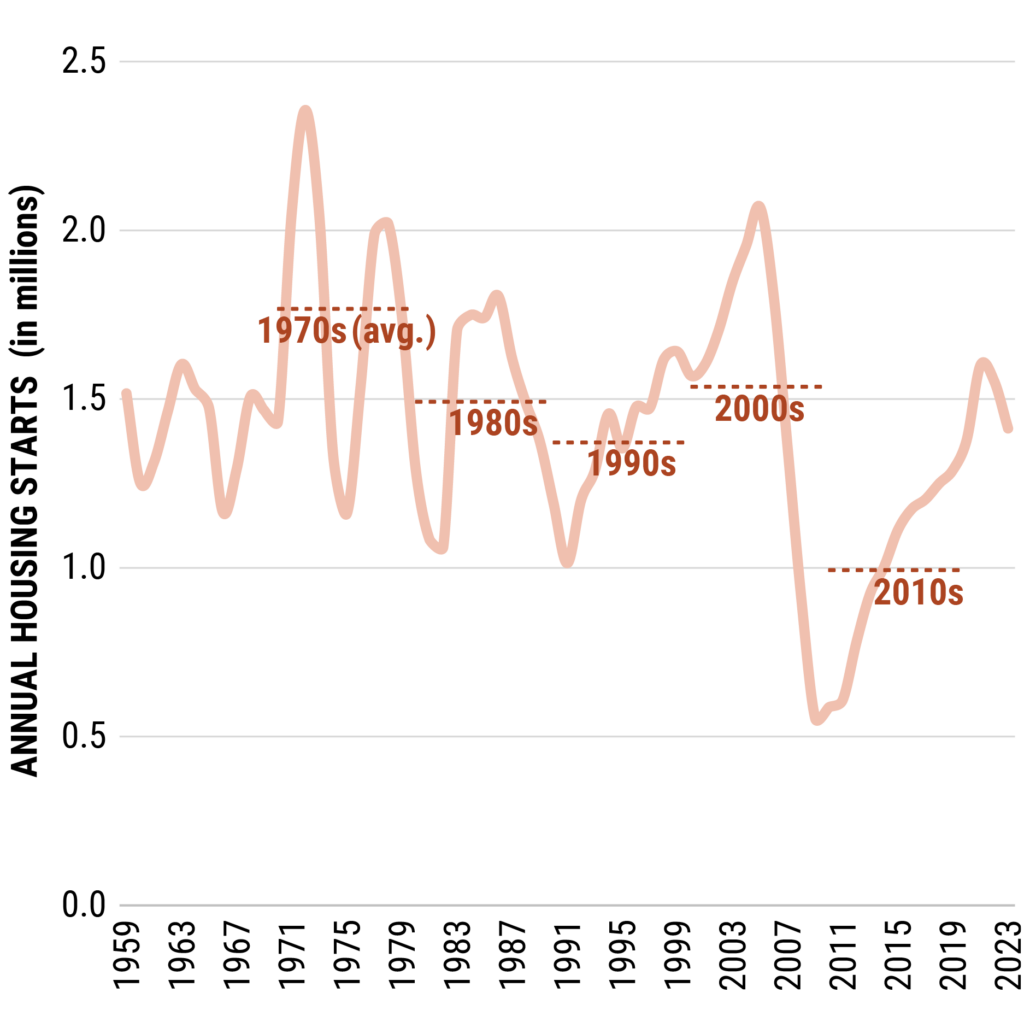

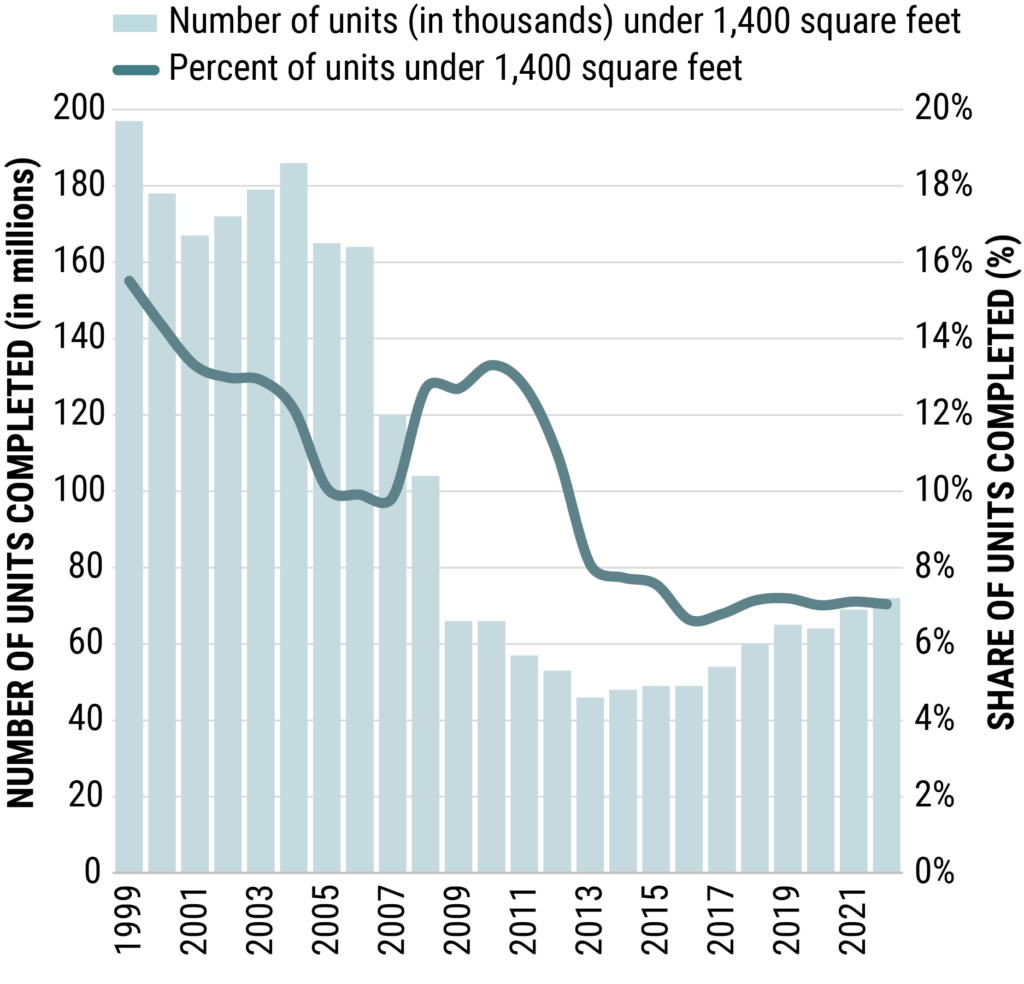

Although the housing shortfall has only recently reemerged as a national discussion topic, conditions for the shortage have been brewing for years—likely since the Great Recession (2007-2009) when the number of housing units started annually declined dramatically and never fully recovered (see Figure 1). In 2020, Freddie Mac estimated that a backlog of 3.8 million homes would be needed to meet demand. Based on a model that incorporates headship rates,[1] income levels, age, education, and housing costs, they concluded that the annual building rate should be 1.6 million homes per year to meet that demand. The continued demand for housing has been fueled by several dynamics including smaller household size, increased savings (due in part to pandemic-era supports), cultural shifts, and a backlog of would-be Millennial homeowners. One potential response to these changes is an increase in smaller, more affordable, entry-level homes. Construction of these starter homes began declining in the 1980s and dropped off dramatically after the Great Recession (see Figure 2). As a result, prices for lower tier homes have outpaced prices for homes in aggregate.

Figure 1. New Privately Owned Housing Units Started

Source(s): US Census Bureau, Survey of Construction; TIP Strategies, Inc.

Figure 2. US Completions of Single-Family Housing Units of Less than 1,400 Square Feet

Source(s): US Census Bureau and US Department of Housing and Urban Development, Characteristics of New Housing; TIP Strategies, Inc.

There are strong arguments that this shortage is driven, at least in part, by supply factors. An analysis in Construction Physics compares the Wharton Residential Land Use Restrictions Index, a measure of regulatory constraint on development, against average rents. The analysis shows a correlation between the two, adding support to the idea that policies that restrict the supply of housing, intentionally or not, raise housing costs. This argument has gained traction in the US, as evidenced by the increasing number of cities choosing to end the use of single-family zoning. The implicit assumption of this policy decision is that density will follow; however, there is evidence to suggest zoning changes aren’t enough.

Policy Tools for Local and State Governments

While the context and conditions that have contributed to the housing affordability crisis are national, there are plenty of actions local and state governments can take to increase housing supply in their communities. Here are three approaches to tackle housing shortages.

1. Take a multi-pronged approach to housing policy. In the years after Minneapolis approved a plan that eliminated single family zoning (which comprised 70 percent of its total land use), permitting of smaller apartments doubled, yet prices for single family homes increased. However, the city saw different results when it passed complementary reforms, including eliminating parking requirements, allowing accessory dwelling units (ADUs), and reducing the cost of adding apartments. Housing permits nearly doubled from 2015 to 2021, with 90 percent issued for buildings with at least 10 units.

A study using data from the Greater Boston Area supports this multi-pronged approach. To increase supply, the study found, expanding multifamily zoning or relaxing height restrictions weren’t enough; steps like relaxing density restrictions were also required to achieve the desired result. Highly targeted measures, like relaxing density restrictions near transit nodes, were also found to yield significant benefits.

2. Be creative with incentives. The higher interest rates of the last year are creating an additional hurdle for cities looking to increase housing supply. High prices and higher interest rates have reduced demand in many parts of the country and increased the cost of financing for developers resulting in a decline in construction activity. Housing is a fragmented industry, unable to pivot quickly in response to demand changes. After the Great Recession, it took nearly a decade for the industry to resume its previous pace of construction. In addition to regulatory incentives, such as increased density allowances and reduced parking requirements, offering fee rebates or tax credits for homebuilders that create housing at needed price points and pass those savings on to first-time buyers could help revive development.

3. Leverage new federal funding sources. Local governments and regional planning organizations can also leverage new federal resources, like HUD’s Pathways to Removing Obstacles to Housing (Pro Housing) program and other efforts aimed at expanding homeownership. Pro Housing offers grants of up to $10 million for communities to identify and remove barriers to affordable housing, including addressing restrictive zoning, land use, and regulatory policies.

These reforms are unlikely to have a positive impact for very low-income residents. For these individuals, subsidized and public housing will remain an important component of housing policy, one that deserves more attention.

But the message is clear: policy tools designed to expand the housing supply should be part of the affordability discussion.

[1] Headship rates represent the number of households divided by the adult population. At the national level, headship rates provide a measure of household size. When calculated for a specific population (e.g., age cohorts, racial or ethnic groups) they provide a measure of the rate of household formation for the group of interest.