Aligning Local Strengths with Regional Innovation

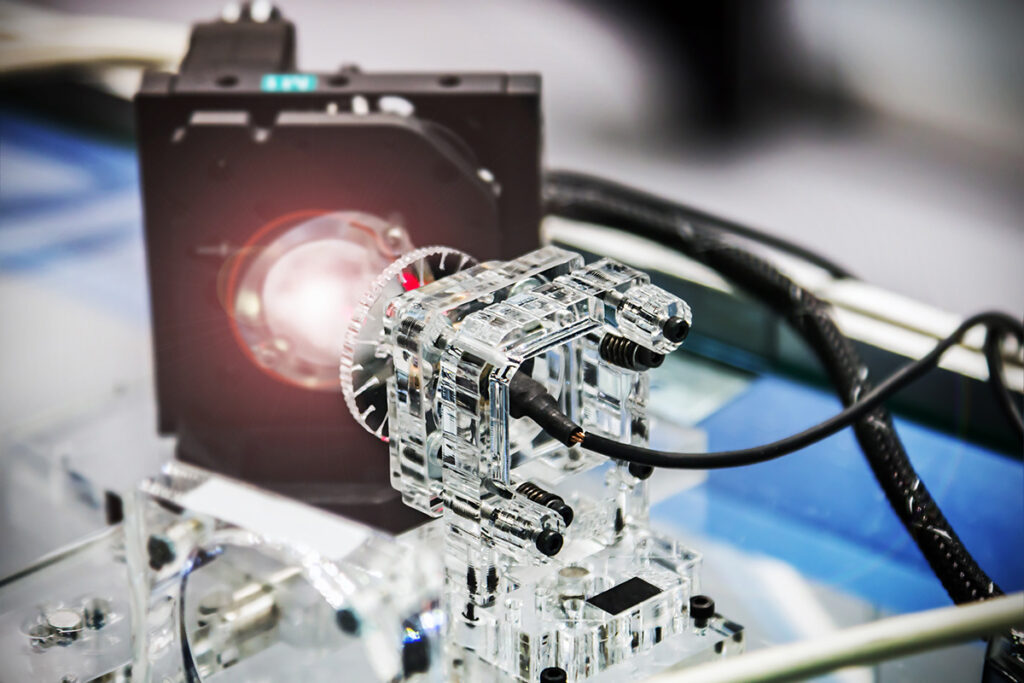

Smaller communities near major metros can build thriving tech economies by aligning local assets with regional industry strengths. TIP’s work in Rock Hill, South Carolina, and Sahuarita, Arizona, illustrates how targeted niche development—in this case, fintech and photonics—can position these communities for sustainable long-term growth.